Scams, and the con artists behind them, are forever evolving and becoming more sophisticated and harder to spot.

ACM has compiled a list of current scams identified on sites such as scamwatch.gov.au, cyber.gov.au and the Australian Competition and Consumer Commission’s website dedicated to informing people about fraudulent and dishonest activities.

Advertisement

Fixed term deposit scams

- People are being warned of a sophisticated and evolving scam targeting investors.

- ASIC is alerting investors about fake fixed term or high interest deposits in various currencies claiming to be a ‘new breed of investment’.

- Offers appear to include common phrases such as ‘beating inflation’ and ‘meeting liabilities’.

- These offers often include the unauthorised use of the Australian Government Coat of Arms and ASIC’s and/or APRA’s logos.

- Scammers copy contract documents from real financial firms & replace the contact details with their own.

- ASIC is urging people to be wary of unsolicited contact, especially when the person contacts you to invest. If someone contacts you, hang up or do not reply.

- Investors should also be suspicious of interest rates that are higher than other alternatives. If an investment offer guarantees higher returns than other investments in the market, it is either high risk or it could be a scam.

- The use of phrases like ‘A new breed of investment’ or ‘Sustainable income / capital growth / beating inflation / meeting liabilities’ may also indicate that the “opportunity” is a scam.

- Documentation with the Australian Government Coat of Arms and ASIC’s and/or APRA’s logos. Any offer of financial products containing ASIC’s logo, the Australian Government Coat of Arms, or APRA’s logo, is a scam.

- For more information about investment scams and what to look out for, visit the Investment Scams page on ASIC’s MoneySmart website.

Coles scam alerts

- Coles, on its website, is advising customers to be aware of text messages, phone calls, websites, competitions and other unsolicited contact that use the Coles brand without Coles’ permission.

- These offers predominantly attempt to collect your personal details, financial information or request payment for goods or services.

- Coles says it will never request personal or banking details in unsolicited communications and legitimate businesses or government agencies will never request payment in gift cards.

- Consumers are encouraged to be wary of requests to complete customer satisfaction surveys that promises a reward at completion – where you are asked for personal details or financial information; sharing/liking a Facebook post in exchange for a gift card/voucher; calling a specific phone number and providing personal information; clicking on an email that links with a malicious website; purchase and provide the redemption code from gift card/vouchers.

- The retailer is also reminding customers that all communication from Coles social media accounts will have a blue verified tick.

- Customers are being contacted by scammers claiming to be from a government agency or business, or receiving emails claiming to be from someone they trust, such as their boss and urged to purchase gift cards at their local Coles store to pay for items such as a tax debt/fine to avoid arrest, an outstanding bill for goods or services, for team rewards or just as a favour. They are then instructed to provide the 16-digit code (from the back of the card) and once done the card is emptied and the customer has lost their money.

Don’t download the app

- Scamwtch.gov.au is warning people not to fall for one of the latest scams doing the rounds which involves unsuspecting victims downloading a “customer service” app.

- Scammers might call claiming to be from a bank or other financial institution.

- They may ask you to download a ”customer assistant app”.

- Doing this gives them remote access to your device.

- From there, they can easily steal your passwords and drain your bank accounts.

- Never give a stranger remote access to your device.

Has your account really been suspended? Or is it a scam?

- Text messages, emails and other notifications that say your account has been suspended may seem like they require urgent action but in reality, they could be a scam.

- Phishing texts such as these aim to create a sense of urgency that encourages you to act quickly, according to Scamwatch.

- In reality, the link is a scam designed to steal your card and banking information.

- If you’re concerned, log into your account as normal or contact your account organisation directly.

- Do not click on the link.

Be wary of ‘free’ offers

- Scamwatch is urging people not to fall for the word “free” when it comes to offers of products, investments, or job offers.

- Scammers play on your emotions and lure you in with false promises.

- Always think twice about giveaway offers – they could be phishing for your personal and financial information.

- By sharing the offer, you could be helping them scam others too.

‘Mum and dad’ scams

- Scamwatch is urging people to beware of “mum and dad” scams targeting unsuspecting parents.

- Scammers are posing as family members using a different number and asking for money.

- Often they will start a conversation using evasive language by telling the parent that they are the “youngest and cutest” of the siblings in an effort to build trust and avoid giving actual proof of the relationship.

- The scammer will likely say they had to get a new phone number or messaging device.

- They might even ask you to block or delete their ‘old’ number.

- The motive behind the scam is to convince the parent that they should transfer money to the scammer.

- Once the unsuspecting parent is engaged in the in conversation, the scammer will likely ask to borrow money or have a payment made on their behalf.

- The scammer may say that online banking is unavailable on the new device – and an offer to pay it back.

- If you get a message like this, always call your relative on their usual number to confirm.

- Do not transfer money without confirming the identity of the recipient.

- It is understood that this scam has defrauded Australians of more than $2 million already.

- If you have lost money to a scam contact your bank or financial institution as soon as possible and report the matter to police.

- It is unlikely that a victim we recover money lost to a scam but there are measure victims can take to prevent further loss.

- Visit www.scamwatch.gov.au/get-help/where-to-get-help to find out more.

Fake investment scams

- Losses to imposter bond investment scams have nearly tripled in the first half of this year with consumers losing over $20 million to these sophisticated scams, according to scamwatch.gov.au.

- Imposter bond scams usually impersonate real financial companies or banks and claim to offer government/Treasury bonds or fixed term deposits.

- People often fall victim to them after searching online for investment opportunities and completing inquiry forms via fake third-party comparison sites.

- The latest Scamwatch data reveals there were 228 reports of imposter bond scams between January and June, compared with 82 reports in the first half of last year.

- Losses suffered by Australian victims of imposter bond scams increased by 265 per cent in the first half of the year, compared to the same period last year. However, the true losses to these scams are likely to be much higher, as research shows that only around 13 per cent of scam victims report their losses to Scamwatch.

- As interest rates rise, people looking to invest in bonds are falling victim to these scams after searching online for investment opportunities. This is often after they complete inquiry forms on fake third-party comparison websites.

- These comparison sites can appear very convincing, and people are providing their details under the impression that these are legitimate Australian sites comparing real financial services.

- Convinced they are making a long-term, legitimate investment, it’s common for victims to deposit larger sums upfront and not check their account for months before realising they were scammed.

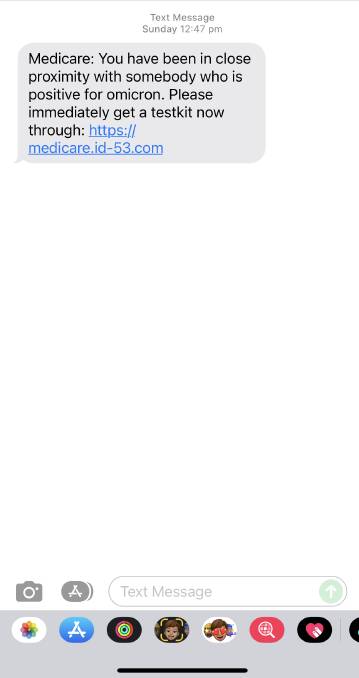

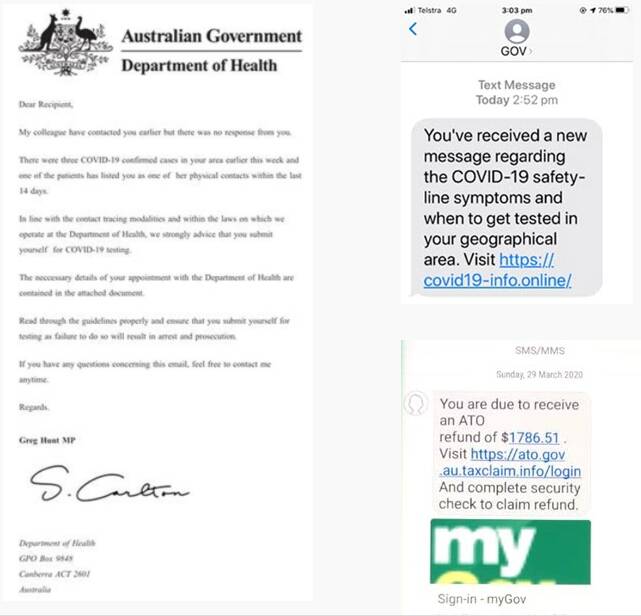

Another health scam

- Fraudsters have ramped up text messaging scams that target Australians during the pandemic.

- The latest text phishing scam involves an SMS claiming to be from Medicare.

- The text identifies the recipient as a close contact of someone who has tested “positive for omicron” (sic).

- It advises the recipient to order a “testkit” via a link included in the message.

- People who received this message are advised not to clink on the link but to delete the text immediately.

- Scammers pretending to be government agencies providing information on COVID-19 through text messages and emails are “phishing” for your information.

- These contain malicious links and attachments designed to steal your personal and financial information.

- Don’t click on hyperlinks in text/social media messages or emails, even if they appear to come from a trusted source.

- Never respond to unsolicited messages and calls that ask for personal or financial details – just press delete or hang up.

- Never provide a stranger remote access to your computer, even if they claim to be from a telco company such as Telstra or the NBN Co.

- To verify the legitimacy of a contact, find them through an independent source such as a phone book, past bill or online search.

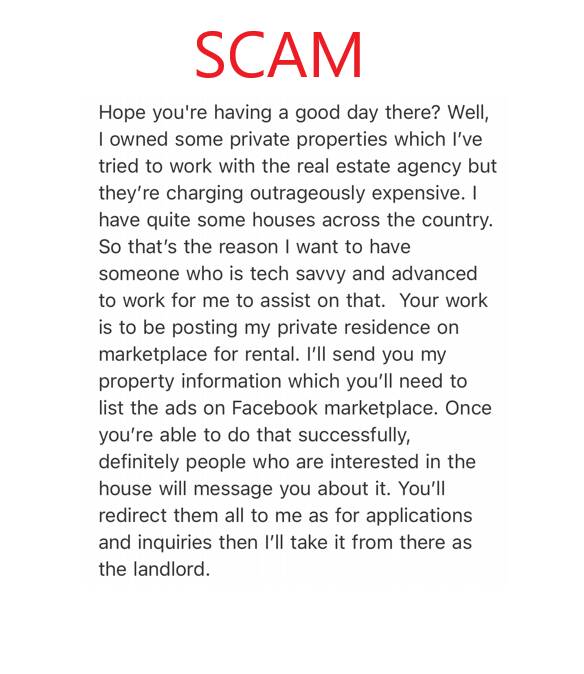

It’s a rental scam but with a twist

- Rental scams offering places to live have been doing the rounds on social media sites such as Facebook for quite a while but now there’s a new way scammers are avoiding detection.

- Traditionally these scams target people seeking new rental accommodation by offering fake rental properties to convince people into handing over money or personal information.

- The latest scam involves unsuspecting victims being hired to list a property for rent on classified sites.

- The target is being used as a rental mule to pass applicants’ personal information and money to a scammer.

- The scammer may reach out via social media and ask to employ such services as property management, social media expertise or general admin duties.

- They may say that they own multiple properties and want to use a private manager to handle their affairs’ for a fee.

- The scammer may also say they wish to avoid paying ‘exorbitant’ fees associated with professional real estate agents.

- Scamwatch is urging people to be cautious of such advertisements or tactics.

Money recovery scams

- Scamwatch has issued a warning to anyone who has lost money to scams, not to be fooled twice by fraudulent behaviour.

- If you’ve lost money to a scam, beware of anyone who approaches you and offers to help get your money back.

- These scams target people who have already lost money to a previous scam by promising to help victims recover their losses after paying a fee in advance.

Advertisement

Scams associated with online shopping

- People looking to capitalise on mid-year online sales are being urged to watch out for the latest associated scams doing the rounds.

- According to scamwatch.gov.au shoppers in a rush to secure discount prices associated with mid-year sales are more likely to fall victim to scams.

- Australia Post is warning that scammers are trying to impersonate the postal service with fraudulent text messages alerting to a parcel delivery.

- The text may say that delivery is unlikely to occur that day and will provide a link to various options for parcel retrieval.

- This text message is known as a phishing scam and should be deleted immediately.

- Phishing messages are designed to look genuine, and often copy the format used by the organisation the scammer is pretending to represent, including their branding and logo.

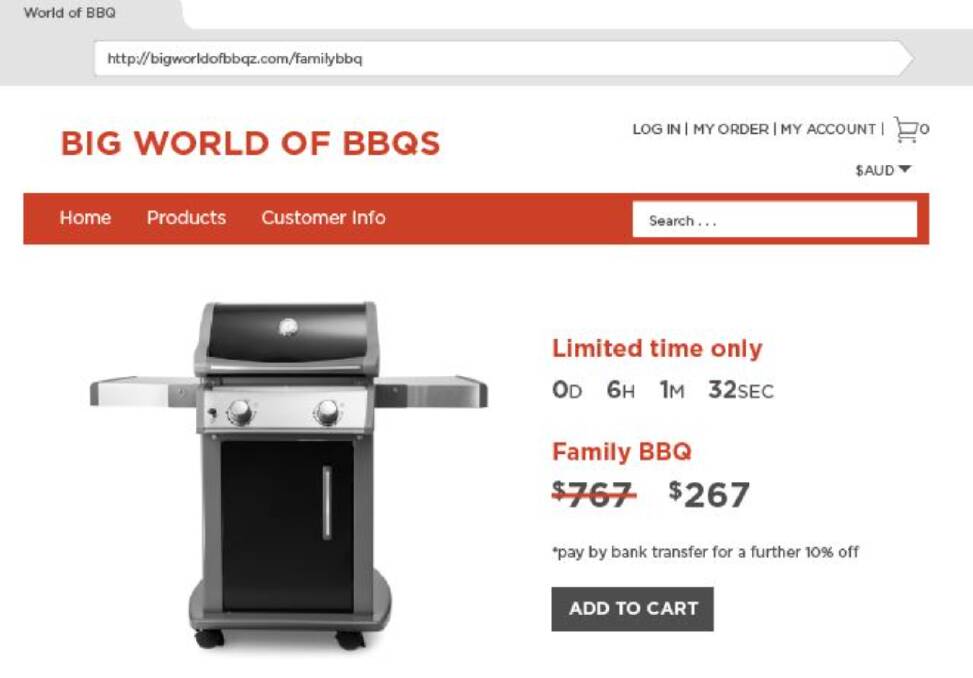

- Consumers are also being warned of fake online deals during the sales season.

- Australians lost more than $12.9 million to such scams in 2021.

- In an online shopping scam, scammers create realistic looking fake online stores selling items at heavily discounted prices, however the items are fake, or never delivered to buyers.

- Scammers have also created fake stores on social media platforms or post fake ads on legitimate classifieds websites. They may request payment or offer discounts for payments made through direct bank transfers or cryptocurrency.

- Some scammers try to make online stores look legitimate by requesting payment via PayPal or credit card, always double check that the real PayPal platform is being used.

Tax practitioner scams

- It ‘s tax time and unfortunately that means there are several news tax related scams doing the rounds.

- The Tax Practitioners Board (TPB) is warning people to be extra vigilant of scams aiming to lure unsuspecting honest consumers into using the tax services of unregistered preparers.

- According to the TPB, unregistered preparers operate outside of the law, often making money by skimming a portion of their clients’ refunds and charging inflated fees for return preparation services.

- They attract new clients by promising large refunds.

- Some will encourage filing fraudulent claims for refunds on items that their clients aren’t entitled to, while others will obtain myGov sign in details from clients, putting their personal information at risk.

- The TPB recommends visiting its website for its online guide which offers tips for avoiding unregistered preparers.

- Check your tax practitioner is registered on the public register at tpb.gov.au/onlineregister.

- Only registered tax practitioners can charge a fee for tax agent services.

- Be sceptical if an agent offers to secure you unexpected or unexplained payments.

- Never share your myGov password with anyone, even your registered tax agent – doing so puts your personal information at risk.

- You should not allow anyone else to lodge or prepare your tax return through your myGov account.

- Visit www.tpb.gov.au/tpb-taxtime-2022 for more information on unregistered preparers and related scams.

- You can report scams to www.scamwatch.gov.au

Criminals targeting job seekers

- Queensland Police, the Australian Federal Police and Australian Border Force are warning the community to be vigilant online, following investigations identifying criminals are using social media to recruit people to unknowingly act as drug couriers.

- Investigators are warning that international drug syndicates are turning to social media platforms to recruit job hunters, to unknowingly receive, store or transport international packages containing illicit drugs.

- In one failed drug smuggling attempt, investigators stopped a Brisbane man, who thought he had accepted an online job offer delivering packages for a construction company, from transporting 2 kilograms of methylamphetamine concealed in an international parcel. The man had been approached after posting a work wanted ad online and was offered $250 for each delivery.

- According to police, the trend is not unique to Queensland and criminals are targeting people from across Australia.

- Investigators are encouraging the community to stay vigilant by researching any potential employer and conducting your own background checks to ensure their details and offer are legitimate and lawful.

- Conduct your own independent checks such as verifying the organisation’s contact details, website and checking their ABN if based in Australia.

- A reverse image search of a profile picture can also be a useful research tool.

- If you have been the victim of a cybercrime, you can report this online at ReportCyber at www.cyber.gov.au/acsc/report or via Scamwatch at www.scamwatch.gov.au

Advertisement

Tax time scams

- The Australian Taxation Office is warning of an increase in email phishing scams claiming to be from the ATO.

- These scams tell people their ‘2022 tax lodgment’ has been received.

- The email asks them to open an attachment to sign a document and complete their ‘to do list details’.

- Opening the attachment takes you to a fake Microsoft login page designed to steal your login details. Entering your password could give the scammer access to your Microsoft account, allowing them to reset your passwords for other accounts like banking and online shopping.

- If you get an email like this, don’t click on any links or open any attachments. Forward the email to ReportEmailFraud@ato.gov.au, and then delete it.

- The real ATO will never send you an email or SMS with a link to log in to online services.

- And while the organisation may use email or SMS to ask you to contact them, they will never send an unsolicited message asking you to return personal identifying information through these channels.

Fake TFN/ABN application scams

- The ATO is also warning people to be on the look out for scams involving fake tax file number (TFN) applications.

- These scams tell people they can help them get a TFN for a fee. But instead of delivering this service, these fraudulent websites steal the person’s money and personal information.

- Such scams are often advertised on social media platforms like Facebook, Twitter and Instagram.

- Applying for a TFN is free. Visit: https://ift.tt/hOa4Fkq

Jobs and employment scams

These types of scams are not knew but are doing the rounds once again.

- Job seekers are being urged to watch out for fake employment scams that offer ‘guaranteed’ ways to make lots of money, very fast, according to Scamwatch.

- The scammer contacts you by email, letter or phone and offers you a job that requires very little effort for high returns, or a guaranteed way to make money quickly. You may even come across false job opportunities on classified ad websites.

- The job on offer may require you to do something simple such as stuffing envelopes or assembling a product using materials that you have to buy from the ’employer’.

- To accept the job you will be asked to pay for a starter kit or materials relevant to the job or scheme.

- If you pay the fee you may not receive anything or what you do receive is not what you expected or were promised. For example, instead of a ‘business plan’, you may be sent instructions for how to get other people to join the same scheme.

- On completion of your work, the scammer will refuse to pay you for some or all of your work, using excuses such as the work not being up to the required standard.

- Another type of job opportunity scam asks you to use your bank account to receive and pass on payments for a foreign company. The scammers promise you a percentage commission for each payment you pass on.

- If you provide your account details the scammer may use them to steal your money or commit other fraudulent activities.

- Scamwatch warns to be suspicious of unsolicited ‘work from home’ opportunities or job offers, particularly those that offer a ‘guaranteed income’ or require you to pay an upfront fee.

Tip for spotting a romance scam

Advertisement

- Scamwatch has offered advice to help identify a romance scammer, online shopping scam or even a puppy scam.

- Scammers steal photographs of real people to create realistic profiles.

- Reverse image searches of profile pictures can help you spot the difference between a genuine and a fake profile – it can also confirm if the image has been used before in a scam.

- You can use Google’s reverse online image search of photos, and if the suspect profile photo appears under different names, you may have caught yourself a scammer.

- On a computer or device: open a web browser, like Chrome or Firefox then go to Google Images. Click Search by image, click ‘upload an image’ and Choose File or Browse. Select a picture from your computer Click Open or Choose.

- Visit Google Search Help for more advice on doing an online reverse image search.

Tradie scams doing the rounds

- Scammers aren’t always online, Scamwatch is urging people to be aware of fake tradies that may come knocking on your door.

- Fake tradies will often high-pressure sales tactics to get your money.

- Remember, if a deal seems too good to be true, it usually is.

- They ask for payment before starting the work and, once they are paid, they then disappear with your money regardless of whether they begin the work or leave the work unfinished or of a substandard quality.

- They look for houses that have handrails and ramps, often targeting older resident and may offer driveway resurfacing, house painting, gardening or tree cutting, roof and guttering repairs, and carpet cleaning.

COVID-19 scam texts

- Scamwatch advises that COVID-19 scam texts urging you to order free test kits are still doing the rounds.

- Text messages claiming to be from Medicare, stating “you have been in close contact with someone who has contracted COVID-19” and to order a “free Test Kit” with a link.

- Do not click on links in unexpected text messages.

- If you are unsure whether this is a true message from the government, log into your MyGov inbox.

Click Frenzy scams

- Consumers looking to bag a bargain during the online ‘Click Frenzy’ sales are being urged to use caution and buy from reputable outlets.

- Click Frenzy is an e-commerce outlet that offers sales events throughout the year. Some scammers have aimed to capitalise on the sale events buy luring buyers to their own fake websites.

- Scammers use the latest technology to set up fake retailer websites that look like genuine online retail stores.

- They may use sophisticated designs and layouts, possibly stolen logos, and even a ‘.com.au’ domain name and stolen Australian Business Number (ABN).

- Many of these websites offer luxury items such as popular brands of clothing, jewellery and electronics at very low prices. Sometimes you will receive the item you paid for but they will be fake, other times you will receive nothing at all.

- The biggest tip-off that a retail website is a scam is the method of payment. Scammers will often ask you to pay using a money order, pre-loaded money card, or wire transfer, but if you send your money this way, it’s unlikely you will see it again or receive your purchased item.

- A newer version of online shopping scams involves the use of social media platforms to set up fake online stores. They open the store for a short time, often selling fake branded clothing or jewellery. After making a number of sales, the stores disappear.

- They also use social media to advertise their fake website, so do not trust a site just because you have seen it advertised or shared on social media.

- The best way to detect an fake trader or social media online shopping scam is to search for reviews before purchasing.

Advertisement

Travel scams

- Adventurers keen to start travelling again are being warned of holiday-related scams.

- Fake websites will often advertise holiday deals that seem to good to be true.

- Often the scammer will convince a victim to pay a deposit or total amount for a holiday package. Once the funds are received the scammer disappears.

- Only book from secure sites that are known and trusted.

- Always check each website’s URL to make sure it’s legitimate and secure.

- If purchasing from a company for the first time, research and check reviews.

- Never wire money directly to a seller.

- Avoid paying for items with pre-paid gift cards. In these scams, a seller will ask you to send them a gift card number and PIN.

Rental scams

- These scams target people seeking new rental accommodation by offering fake rental properties to convince people into handing over money or personal information, according to www.accc.gov.au.

- The scammer will post advertisements on real estate or classified websites or target people who have posted on social media that they are looking for a room.

- After the victim responds, the scammer will request an upfront deposit to secure the property or phish for personal information through a ‘tenant application form’, promising to provide the keys after the payment or information is provided.

- The scammer may come up with excuses for further payments and the victim often only realises they have been scammed when the keys don’t arrive and the scammer cuts off contact.

- Some scammers will even impersonate real estate agents and organise fake inspections, victims will then arrive to discover the property doesn’t exist or is currently occupied.

- Anyone who suspects they are a victim of a rental scam should act quickly to reduce the risk of financial loss or other damages.

- They should contact their bank as soon as possible and, if relevant, contact the platform on which they were scammed to inform them of the circumstances.

Call back scams

- Text message ‘call back’ scams impersonating Paypal and Amazon are increasing, according to Scamwatch.

- If you get a message like this, just ignore and delete it.

- If you’re unsure, use contact details from their official website.

- Never call the phone number in the SMS.

myGov account suspension scam

Advertisement

- If you’ve received a text message saying your myGov details are wrong, it could be a scam, according to Services Australia.

- The text messages often claim to be myGov.

- The text will state that account details are wrong and need to be updated. They may also threaten to suspend your account.

- It may ask you to update your details via a link to avoid account suspension. Don’t open the link.

- myGov will send texts reminding you to go to appointments, letting you know we’ve paid you, confirming changes to your details, and letting you know you’ve got a new myGov Inbox message.

- myGov will not include links in text messages, or threaten to suspend your account like this scam does.

- To report the scam call (1800 941 126) or email (via the www.servicesaustralia.gov.au website) Scams and Identity Theft Helpdesk straight away.

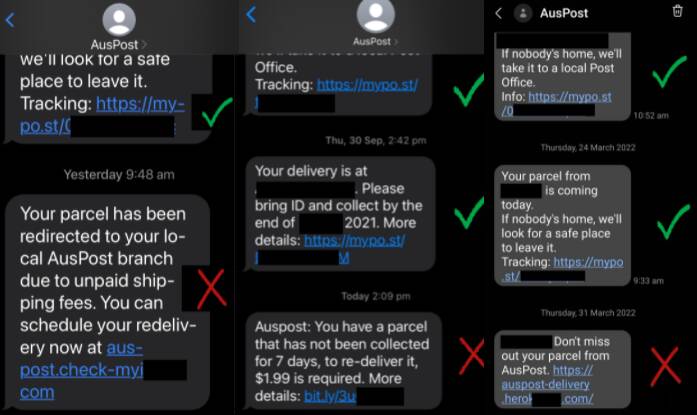

Beware fake Australia Post texts

- Australia Post has reported receiving information from customers about fraudulent text messages claiming to be from Australia Post.

- The test messages claim to be an update for a parcel delivery and prompts customers to click on a link to pay a delivery fee.

- Once clicked, the link will lead to fake Australia Post website which is designed to steal your personal and financial information.

- These scam messages are sent using ‘AusPost’ sender ID and, due to the way smart phones group these communications, the scam text would appear together with the legitimate thread of Australia Post messages.

- Australia Post will never email, call or text you asking for personal or financial information or a payment.

- Australia Post asks customers to report a suspicious email or text message that appears to be from Australia Post to scams@auspost.com.au and delete it immediately.

- If you believe you have fallen victim to a scammer, contact IDCARE on 1800 595 160.

Clues for spotting a fake email

- Scammers can easily fake an official-looking email, using the same logo and design as the real company.

- Often your guard is down when you receive an email from a company you’ve dealt with before, such as Australia Post or an online shopping site you use.

- If you’re not expecting an email, always be alert to a fake before clicking on any links or opening any attachments.

Enjoy Easter but don’t let scammers exploit your holiday cheer

Scammers will exploit people’s holiday cheer and generosity to con them out of their hard-earned money.

Advertisement

According to Scamwatch, the top three scams to look out for are:

Fundraising activities

Easter is often a time for charitable fundraising, especially for children’s charities. Scammers often pretend to work for well-known and well-regarded charity organisations. Scammers may approach people in the street, by knocking on the door, by telephoning or by sending spam emails.

Malicious software and viruses

Scammers use bogus emails designed to spread malicious software and viruses onto your computer. Usually this scam involves using catchy titles and headings to entice you to open the email, such as ‘your friend has sent you an Easter card’.

Bogus holiday and accommodation scams

Advertisement

Easter is a time when many families take vacations. The scammer commonly offers heavily discounted holidays and/or accommodation rates through unsolicited emails and/or telephone calls. This scam usually involves full or significant up-front payments, commonly through cash money wire (which is untraceable).

How to avoid fake charity scams

- If in doubt, find the name of the charity yourself and donate directly to them.

- Don’t rely on any phone number or website address given by the person who first called, visited or emailed you, because they could be impersonating a legitimate charity. Instead find the contact details of the charity through an internet search.

- Never give out your personal or credit card or online account details unless you made the phone call.

- If a collector makes a face-to-face approach, ask to see identification.

Weight loss scam

- The Australian Digital Health Agency is warning consumers not to fall for a weight loss scam running via Facebook spruiking a miracle cure and using the My Health Record logo.

- The ads suggest people can lose 45 kilograms with one teaspoon of the product, a so-called supplement.

- Chief Clinical Adviser Dr Steve Hambleton said the scammers had misused the Agency’s My Health Record logo in the ads.

- “Government agencies don’t lend their logos to companies and My Health Record is a trusted brand, hence our warning,” he said.

- There are reports that the ads run through new, small Facebook pages that are barebones but for the advertisement, registered with names like “Wealth” and Personal variety.

- The ads apparently all link to similarly formatted websites, despite each being hosted on different domains.

- None of the websites has a name or organisation listed as part of its registration records, but two claim to be registered from Iceland.

False billing scams return

- False billing scams are doing the rounds again, according to Scamwatch.

- The scam requests you or your business to pay fake invoices for renewals, advertising or supplies that you didn’t order.

- Scamwatch advises business owners to double check all payment requests and if a supplier’s usual account details have changed, call them to confirm.

Advertisement

Vehicle scams expected to rise

- Beware of vehicle scams on classified sites.

- With recent flooding in QLD and parts of NSW, some people may be looking to offload flood-damaged vehicles or capitalise on people in urgent need of a vehicle.

- The scams are operating on various online marketplaces and classified sites.

- Scamwatch has also received more than 100 reports about someone using variations of the name “Ciara” on classified sites and online marketplaces.

- Beware of excuses for why you can’t view the car in person.

- Visit scamwatch.gov.au for tips on spotting vehicle-related scams.

‘Spoofing’ scams and how to spot them

- Scammers are able to copy phone numbers and email addresses so they appear as a genuine contact, according to Scamwatch.

- This scam tactic is known as ‘spoofing’.

- If you’ve received an unexpected call or email asking for money or your personal details, call the relevant entity directly to confirm.

Phone scams targeting flood affected

- Scamwatch is warning people who have been impacted by the recent floods to beware of scam phone calls from people posing as a service provider and claiming your phone or internet has been affected.

- Never give a stranger remote access to your computer. If concerned, contact your service provider directly.

Advertisement

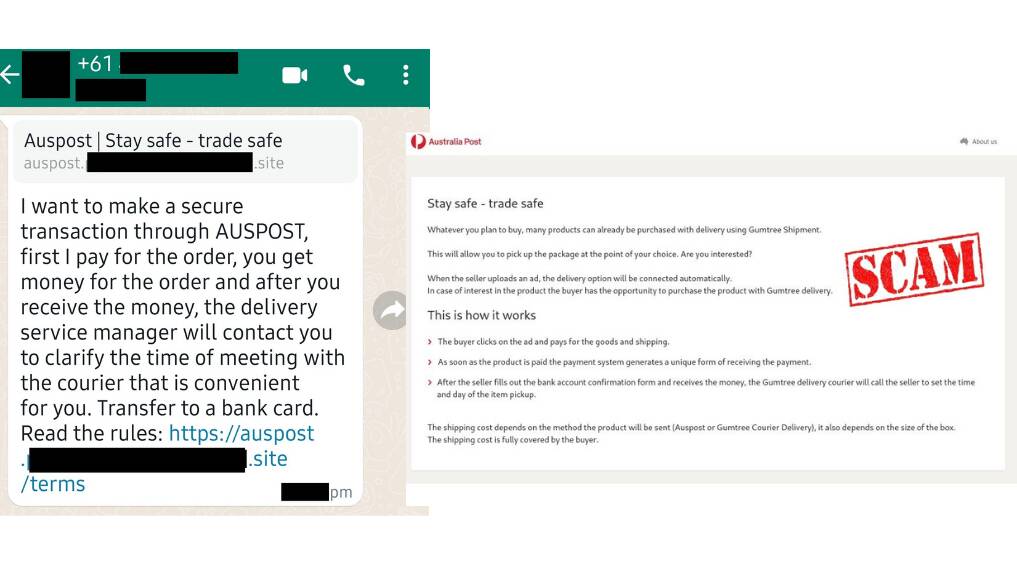

Australia Post scam

- Fraudulent WhatsApp/SMS messages are sent by scammers targeting Gumtree sellers, asking them to click on a link to ‘receive funds’ for the listed item and courier delivery fees.

- The link leads to a fake Australia Post website which is designed to steal debit or credit card details.

- Never clink on a link in a message unless you can verify the sender.

Don’t be scammed out of your donation

- Scamwatch, financial and charitable institutions are urging people wishing to donate to flood or Ukraine charitable appeals to check and make sure their donation is going to a legitimate organisation.

- Scammers often capitalise on a crisis and will try to take advantage of Australians’ generosity and support by setting up fake donation sites, or even posing as insurers, businesses or government organisations offering help to the victims themselves.

- Only donate if you can verify that a charity is legitimate by searching the Australian Charities and Not-For-Profit’s Commission register: acnc.gov.au/charity/programs/map.

Do your research, seek proof before buying pets online

- It can be hard to say no to a cute puppy but don’t rush in and fall for a scam. If you’re looking to buy or adopt a new pet, make sure you meet them in person before putting any money down.

- If you can’t meet your new pet in person, take the time to reverse image search the photos used in the listing, and check with the relevant breeders association before sending any money.

- Do your research and beware of typical scam tactics, like requests for extra money for unexpected additional costs.

Scam protection tip

- No Australian government or law enforcement agency will ever request remote access to your devices. If a “government worker” calls or texts and claims there is a problem with your device and asks to access it remotely, just hang up or delete the message because it is a scam.

Advertisement

Bills, invoices and subscriptions: makes sure it’s not a scam

- Keeping track of subscription payments and bills can be tricky, however Scamwatch is urging people to be cautious about paying invoices that seem suspect.

- The website suggests taking the time to double check unexpected requests for money or personal information.

- Emails that claim a payment was unsuccessful may look convincing, but on second look there could be signs of a scam.

- If in doubt, contact the provider directly.

- Another tip for checking the email’s validity includes looking at the the sender email address extremely carefully – in some cases the sender address may have a very slight difference to it or include a spelling mistake.

Online shopping red flags

- Scamwatch is sharing red flags people should look out for when buying products online. The authority stated that scam websites have become sophisticated and difficult to spot, especially if it is impersonating a legitimate business.

- Look out for products advertised at an unbelievably low price, or advertised to have amazing benefits or features that sound too good to be true, if a site’s social media pages appear new and selling products at very low prices and limited information about delivery and other policies.

- Also be wary if an online retailer does not provide adequate information about privacy, terms and conditions of use, dispute resolution or contact details, or if the seller does not allow payment through a secure payment service such as PayPal or a credit card transaction.

Deny scammers remote access

- Scamwatch has reported that Australians have lost almost $1 million in remote access scams since the start of the year.

- Victims are being contacted by phone by a scammer impersonating tech support or fraud prevention, telling the person their device or account has been compromised and needs support to fix it.

- The scammer ask to remotely access the victim’s computer or phone, to download remote access software and to accept the scammer’s request to access the device.

- Once access is allowed, the scammer accesses the victim’s banking or personal information, uses that information to impersonate the victim to commit identity theft or steal money.

- Scamwatch advises that anyone posing as a service provider, bank or government body asking you to download software and give them access to your device is scamming you and to never give anyone remote access to your device.

Too good to be true job offers

- Scamwatch is reminding the public of the old adage that if an offer seems too good to be true, it probably is, especially in relation to jobs.

- There have been more than 3400 reports made to Scamwatch about employment scams.

- This scam sees a victim receive a job offer, often out of the blue, by text or email. The offer is generic but ‘guarantees’ the person will make fast or easy money. The victim might be asked to pay a fee or purchase a ‘starter kit’, or provide personal details in order to secure the role.

- Scamwatch advises the public to beware of roles that promise big money for little effort, ask for a lot of personal information, or require you to purchase a ‘starter kit’ before you can start working.

Let your head lead your heart

- In a dating and romance scam, scammers build trust over time before asking for money or gifts. They will often claim they need money to come and visit, or to pay for bills or debts. Even if you think you can trust them, don’t send money to someone you have only met online. Scammers also love using gift cards as a payment method as it’s easy for them to sell the cards on for cash. If someone asks for payment in gift cards it is a scam.

Advertisement

MyGov refund scam

- Beware of a new refund scam now making the rounds, and any other emails promising money if you provide your personal details. An email claiming to be from MyGov states ‘your refund is ready’ and asks the recipient to complete the ‘identity verification process’. This is not a legitimate email from MyGov. The from ‘do not reply’ email address is a giveaway that the email is a fake.

Beware rental fraud

- Looking for a new home? Beware of private rental scammers on classifieds sites who claim to have a property available. Search the address to make sure it isn’t listed elsewhere, and always view the property in person before sending any money or personal information.

Hack scam to look out for

- Scammers can spoof (copy) your email address to make it look like they have accessed your device. If you get a message stating someone has accessed your device, has monitored your internet activity and provided ‘proof’ of that activity, this is a sextortion scam – you have not actually been hacked. If you receive an email like this report it to esafety.gov.au.

Hack scam to look out for

- Scammers can spoof (copy) your email address to make it look like they have accessed your device. If you get a message stating someone has accessed your device, has monitored your internet activity and provided ‘proof’ of that activity, this is a sextortion scam – you have not actually been hacked. If you receive an email like this report it to esafety.gov.au.

Online shopping

- When shopping online, beware of scammers who insist on third party payment or delivery services. They might claim to be a FIFO worker, defence personnel, or provide another excuse as to why they can’t conduct the transaction in person. If in doubt, don’t go ahead with the deal.

Advertisement

Educate yourself on scam types

- Phishing scams are attempts to trick you into giving out your personal info. If you receive a request to ‘verify your details’ and provide your bank accounts, passwords or credit card info, something’s phishy. Learn more about how to recognise a scam type at scamwatch.gov.au.

Scamwatch smells a RAT

- Scamwatch has received reports about scams relating to rapid antigen tests (RATs). Avoid newly registered websites claiming to have supply and individuals re-selling tests. Only buy TGA approved RATs from known and trusted retailers or their online stores. In Australia, there are 22 TGA approved RAT tests. Information can be found at tga.gov.au.

Attempts to steal information

Scamwatch has received over 6415 scam reports related to the coronavirus with more than 9 million dollars in losses since the initial outbreak.

With vaccines and RATs in short supply in areas around Australia, some scam artists are taking the opportunity to ask for payment in exchange for early access to vaccines or tests.

Advertisement

Government impersonation

Many scams rely on getting you to click fraudulent links, and will impersonate government agencies or trustworthy groups to convince you to click the link. Fake texts that appear to be sent from a government agency can try and persuade you to give your personal information to fraudsters.

If it seems a government group wants you to check or input information on a website, access the website from a separate browser. Don’t click the link sent, and never share personal or financial information over the phone. Just hang up.

Catfishing cons

Scam artists can and will often target emotional triggers such as loneliness or passion to get you to provide money, information or gifts.

Often through online dating websites but also seen on social media, fraudulent actors will pretend to be romantically interested and even begin a long-term relationship that can last for months before asking for money or information. In some scenarios, they’ll even ask for intimate or revealing pictures that could be used as blackmail material.

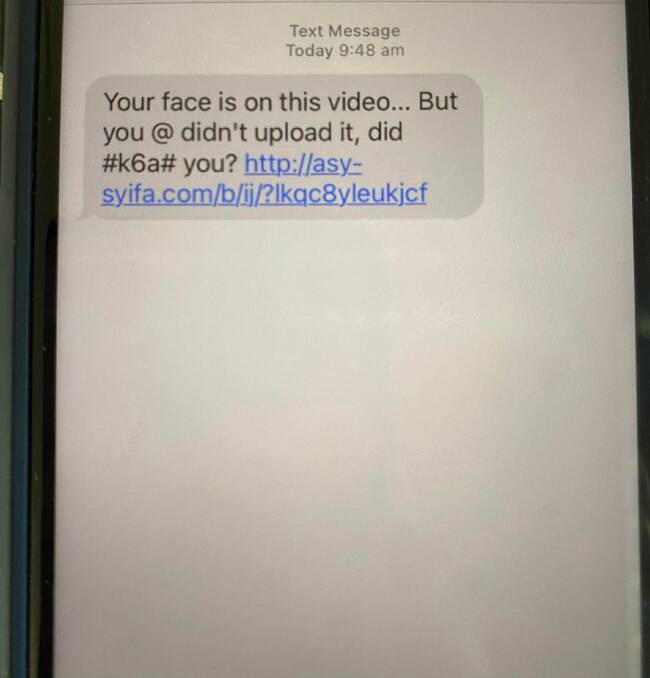

‘Sextortion’ blackmail

On that note, sometimes scam artists will send you threatening text messages or emails threatening you with sharing intimate photos or videos with your friends, family or professional contacts.

Advertisement

These sorts of cons rely on the immediate fear of being embarrassed or shamed publicly to convince you to pay up, but they rarely have any actual material to threaten you with. They are trying to scare you, but that’s all it is. Simply delete the message and don’t engage.

And of course, don’t put photos online that you would be uncomfortable with others seeing.

Flubot scams

Flubot scams are some of the most common attempts to steal information at the current time.

Australians are still receiving scam text messages about missed calls, voicemails, deliveries and photo uploads. The text messages ask you to tap on a link to download or access something. Doing so will download a specific type of malware to your device.

The most common version is preying on the rise in online shopping, offering updates on parcel tracking to convince you to click links sent through text messages. If you can’t verify authenticity, don’t click it.

Advertisement

Golden Rules

Remember, if something sounds too good to be true, it probably is. It’s always best to approach any mysterious messages with skepticism and never click links that you don’t recognise.

Never give personal, revealing or financial information over the phone or to somebody you don’t know and trust.

If in doubt regarding the authenticity, get help. Consult a trusted friend, or contact authorities to verify the information.

Finally, nobody actually wants to be paid in gift cards except scam artists. Government agencies will absolutely never ask you to pay fines or fees with a gift card, and anyone asking for payment in the form of a gift card should be treated with caution.

More information on types of scams, reporting options and updates are available at scamwatch.gov.au.

Advertisement

More from Local News

More from Local News

More from Local News

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Freelancing Jobs – My Blog https://ift.tt/URT318g

via IFTTT

0 Comments